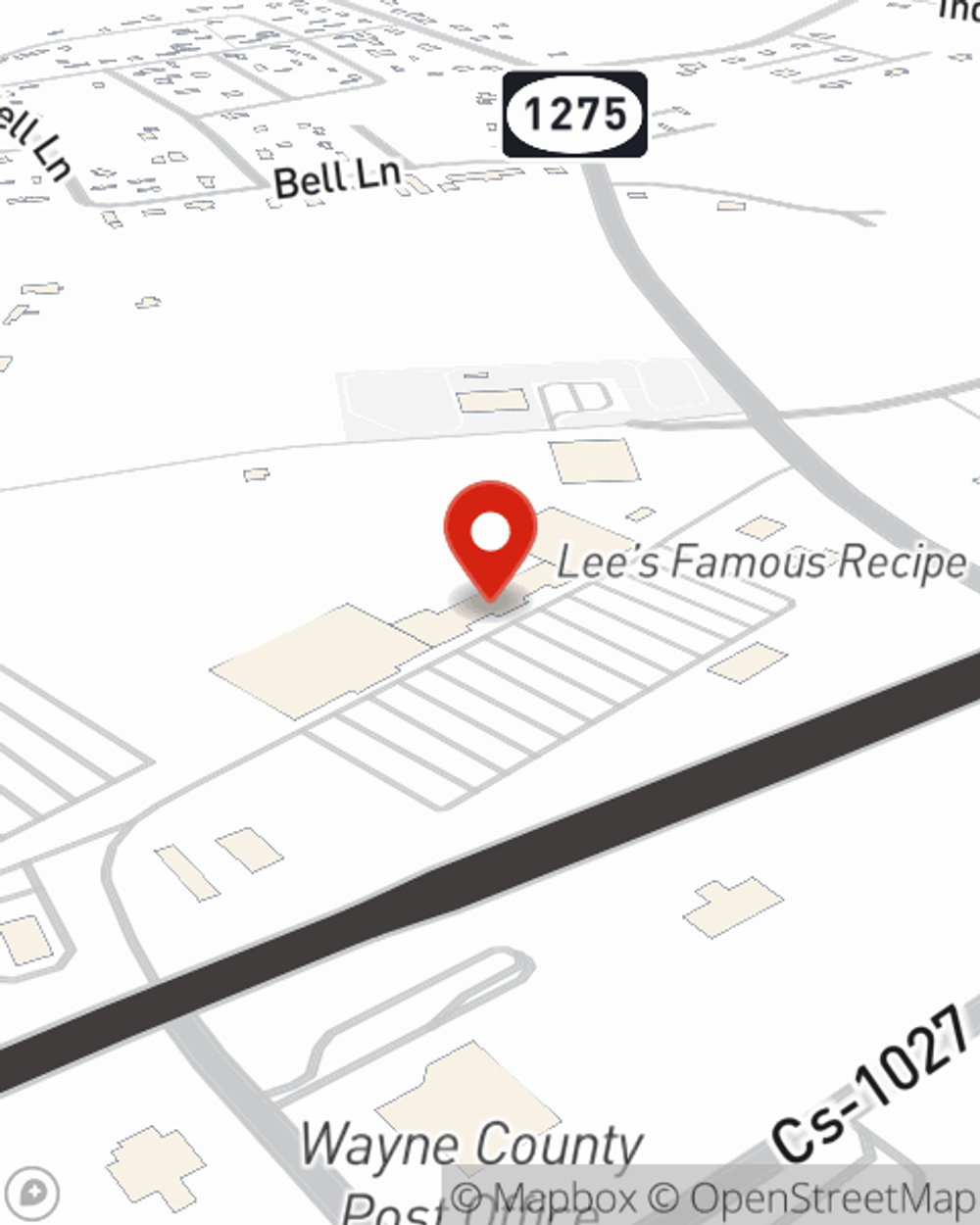

Business Insurance in and around Monticello

Monticello! Look no further for small business insurance.

This small business insurance is not risky

Cost Effective Insurance For Your Business.

You've put a lot of hard work into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a veterinarian, a bakery, a pharmacy, or other.

Monticello! Look no further for small business insurance.

This small business insurance is not risky

Insurance Designed For Small Business

You are dedicated to your small business like State Farm is dedicated to outstanding insurance. That's why it only makes sense to check out their coverage offerings for surety and fidelity bonds, builders risk insurance or artisan and service contractors.

Let's talk business! Call Joe Farmer today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Joe Farmer

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.