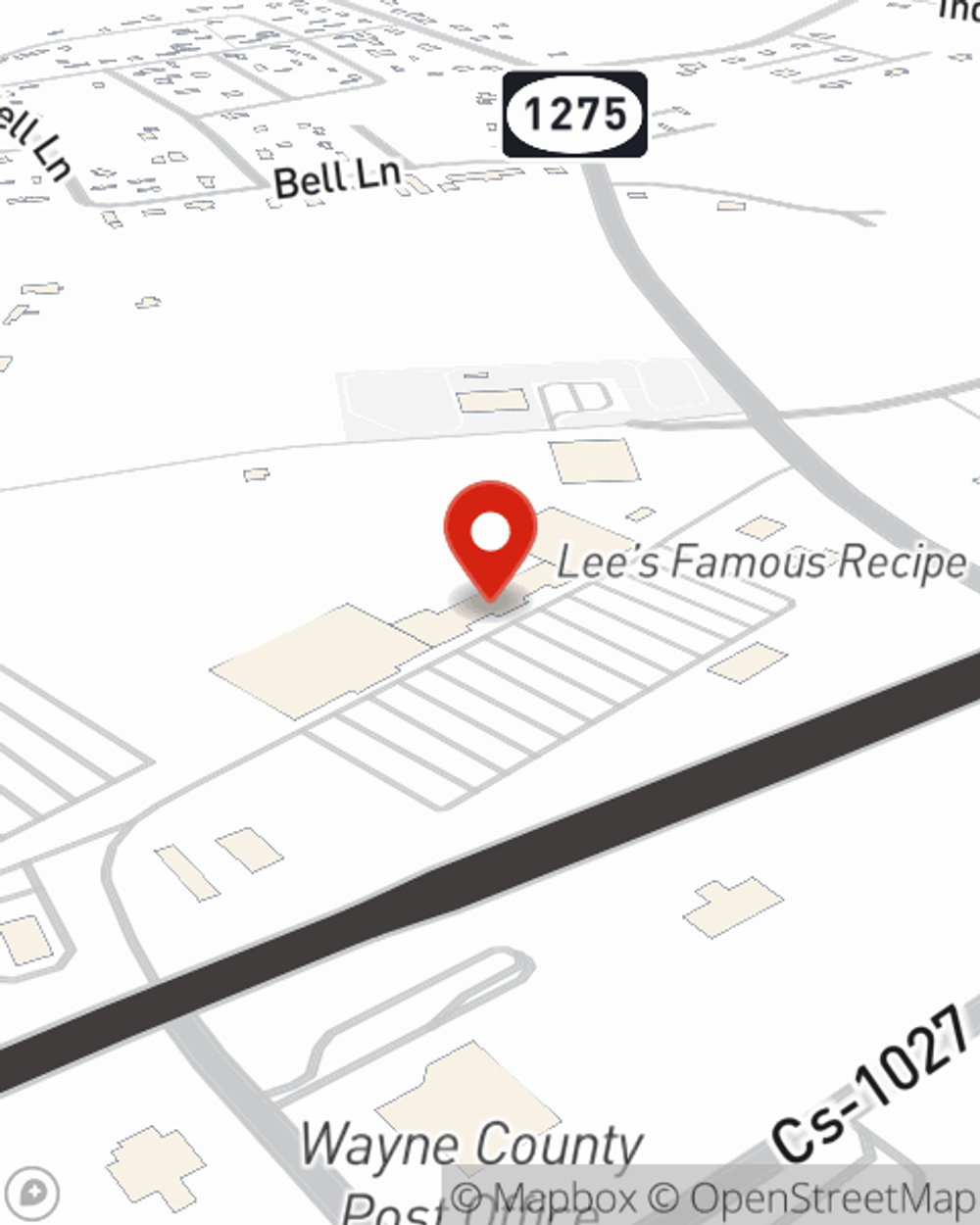

Business Insurance in and around Monticello

One of Monticello’s top choices for small business insurance.

Almost 100 years of helping small businesses

Help Prepare Your Business For The Unexpected.

When you're a business owner, there's so much to keep track of. You're not alone. State Farm agent Joe Farmer is a business owner, too. Let Joe Farmer help you make sure that your business is properly protected. You won't regret it!

One of Monticello’s top choices for small business insurance.

Almost 100 years of helping small businesses

Protect Your Future With State Farm

Whether you are a psychologist a podiatrist, or you own a deli, State Farm may cover you. After all, we've been into small business insurance since 1935! State Farm agent Joe Farmer can help you discover coverage that's right for you and your business. Your business policy can cover things such as loss of income and extra expense and equipment breakdown.

It's time to get in touch with State Farm agent Joe Farmer. You'll quickly learn why State Farm is the reliable name for small business insurance.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Joe Farmer

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.